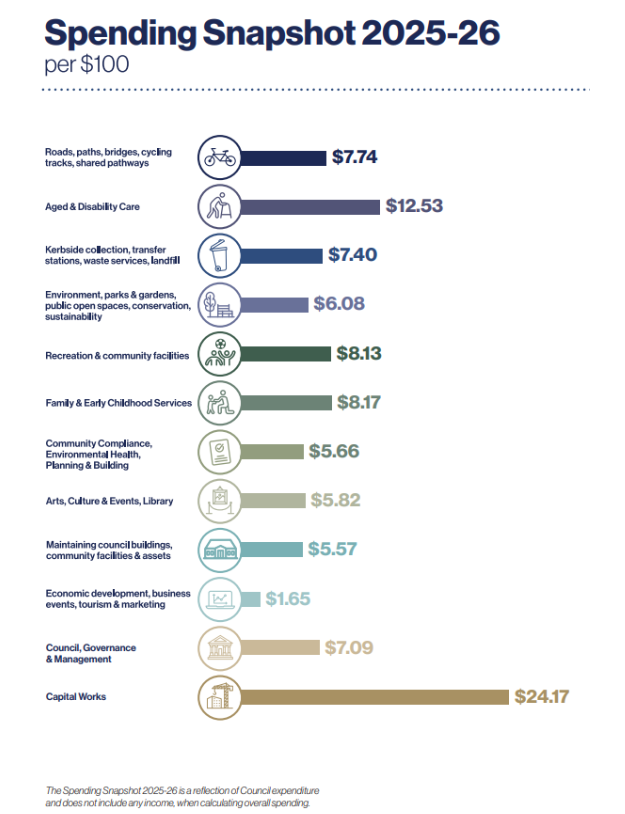

Rates are a critical source of income and allows us to provide a range of services to help our community to enjoy a healthy, active and safe lifestyle. The below shows how much each service receives for every $100 we spend.

On your rates notices, you will also see charges for the collection of your waste and a Emergency Services Volunteer Fund, which helps fund Victoria's fire and emergency services.

How your rates are calculated

Your rates are calculated using the following formula:

Total rate revenue

As part of our annual budget process, we first determine how much funding needs to be raised via rates to help fund local infrastructure and services.

Rate in the dollar

The total rates revenue is divided by the combined value of all rateable properties. The resulting figure is called the 'general rate in the dollar'.

For example, if we needed to raise a total rate revenue of $10millon and the total value of all rateable properties is $2.38billion, the total general rate in the dollar is 0.42 cents ($10million ÷ $2.38billion).

You can see a full list of property types and associated rate in the dollar further below.

Value of your property

Every property is valued using Capital Improved Value (CIV), which means the total market value of the land plus buildings and other improvements (i.e. Swimming pool, landscaping).

Property values are updated each year by valuers from the office of the Valuer-General Victoria. To do this accurately, they may need to visit your property or may request information from you.

Property values vary across a municipality and over time. We do not collect extra revenue as a result of changes in property valuations. Instead, the charges are re-distributed based on changes in each property’s value. The purpose of regular revaluation is to ensure rates are equitably distributed.

If you believe the valuation of your property is inaccurate or unreasonable, you can object to it within a certain timeframe. We recommend you first speak to our Property & Revenue Coordinator on 03 5722 0838.

Municipal charge

Some councils will charge a flat rate charge to offset some of their administrative costs. We do not charge a municipal charge.

Calculating your rate payments

To calculate the total annual rates due, we multiple the CIV by the rate in the dollar.

For example, if the CIV of a property is $376,000 and the rate in the dollar is set at 0.36 cents, the annual rate amount would be $1,354 ($376,000 x 0.0036). This is then divided by four and paid on a quarterly basis. So, you would pay $338.40 per quarter.

If you would like to learn more about how we calculate your rates, you can read our Revenue and Rating Plan 2025-2029(PDF, 634KB).

Our Revenue and Rating Plan establishes the revenue raising framework within which Council proposes to work.

Rate in the dollar by property type

| Property type |

Description |

Rate in $ |

| General |

General land is any land, which is not: Commercial & Industrial land; Rural 1 land; Rural 2 land; Vacant; or Vacant >3yrs, and on which there is a building affixed to the land that is primarily designed and legally permitted for residential use, and which is:

• Located within a Rural Living 1 Zone, Rural Living 2 Zone, Low Density Residential Zone, Township Zone, General Residential Zone, Neighbourhood Residential Zone or Residential Growth Zone under the Wangaratta Planning Scheme: or

• Located within a Farming Zone or Rural Conservation Zone under the Wangaratta Planning Scheme and is less than 8ha in area and not a component of a single farm enterprise (as defined in Section 3 of Emergency Services and Volunteer Fund Act 2012).

|

0.00307 |

| Vacant |

Vacant is any land, which is not General land; Commercial; & Industrial land; Rural 1 land; Rural 2 land; or Vacant > 3yrs and on which no improvement has been made and:

• Has been vacant for less than three years at 1 July of the current rateable financial year.

|

0.00614 |

| Rural 1 |

Rural 1 land is any land, which is not General land; Commercial & Industrial land; Rural 2 land; Vacant; or Vacant >3yrs and which is:

• Located within a Farming Zone or Rural Conservation Zone under the Wangaratta Planning Scheme and is not less than 8ha in area; or

• Not less than 2ha and is a component of a single farm enterprise (as defined in Section 3 of the Emergency Services and Volunteer Fund Act 2012).

|

0.00215 |

| Rural 2 |

Rural 2 land is any land, which is not General land; Commercial & Industrial land; Rural 1 land; Vacant; or Vacant >3yrs which is:

• Located within a Farming Zone or Rural Conservation Zone under the Wangaratta Planning Scheme and is greater than 40ha in area; or

• Not less than 2ha and is a component of a single farm enterprise [as defined in Section 3 of the Emergency Services and Volunteers Fund Act 2012]; and when combined has a total area greater than 40ha.

|

0.00184 |

| Commercial & Industrial |

Commercial & Industrial land is any land, which is not; General land; Rural 1 land; Rural 2 land; Vacant; or Vacant >3yrs and which must contain a building that is primarily used for

• Sale of goods or services

• Other commercial purposes

• Industrial purposes and is not the owner’s principal place of residence and is allocated an Australian Valuation Property Classification Code that correlates with the Commercial or Industrial classification of the Emergency Services and Volunteers Fund.

|

0.00445 |

| Vacant > 3 Years |

Vacant > 3yrs is any land, which is not General land; Commercial & Industrial land; Rural 1 land; Rural 2 land; or Vacant and on which no improvement has been made and:

• Has been vacant for three or more years; and

• Has not changed ownership within the last three years as at 1 July of the current rateable financial year.

|

0.00737 |

What is rate capping?

Our general rates are subject to a rate cap set by the Minister for Local Government each year. This means that our total general rate revenue cannot increase by more than the cap.

What does the rate cap apply to?

The rate cap applies to general rates. It does not apply to waste charges which are driven by the cost of providing the service. The Emergency Services Volunteer Fund is also not subject to the rate cap.

The rate cap for 2025/26 has been set at 3.00%

Does this mean that my overall rates will only increase by the rate cap?

It is important to know that the rate cap does not apply to your individual rates notice, but rather the total amount of general rate revenue raised. The rates and charges for your property may increase or decrease by a different percentage to the rate cap due to:

- The valuation of your property relative to the valuation of other properties in the municipality

- The application of any differential rate by Council

- The inclusion of rates and charges not covered by the rate cap.

Where can I find more information?

You can find out further information regarding Fair Go Rates System here.

We also collect a waste charge to cover the cost of collecting and disposing of your garbage, recycling and organic waste. The amount charged depends on the size of your bin and whether you live in an urban or rural area.

| Waste type |

Urban |

Rural |

| Garbage |

|

140L - $226

240L - $400

240L Weekly - $810

|

| Recycling |

240L - $174

360L - $229 |

240L - $174

360L - $229

|

| Organics |

240L - $208 |

N/A |

| Glass |

80L - $0 |

N/A |

Property owners must pay an annual levy via their council rates to help fund Victoria's fire and emergency services. We collect this levy on behalf of the State Government. You can find out more information here.

The levy comprises of two parts - a fixed charge and a variable charge. The variable charge varies depending on the property's location, classification and capital improved value (CIV).

| Property type |

Fixed charge |

Variable charge (cents per $1000 of CIV |

| Residential land (including vacant) |

$136 |

17.3c |

| Commercial land |

$275 |

133c |

| Industrial land |

$275 |

133c |

| Primary Production land |

$275 |

28.7c |

| Public benefit land |

$275 |

5.7c |

Single farm enterprise exemption

You can apply for an exemption if you own or occupy 2 or more parcels of farmland which are used for a single farm enterprise (SFE). Eligible SFE's may only need to pay fixed charge once for the property.

You can apply for an exemption using the SFE Application Form(PDF, 251KB).7